09 May James Doyle Heads up Business Interruption Claims

Posted at 19:57h

in Business Interruption Claims

No Win, No Fee, No Risk

We work on a no-win no fee basis, therefore, you won’t pay a single penny unless you have a successful claim. At the Legal and Claims Group, we work with the UK’s top solicitors. Therefore, we have a 95% success rate. We will cover all costs up until you have a successful claim. So, what are you waiting for? As there could be a limited time to submit your claim. Hit the button below to get your instant valuation and get your claim started!

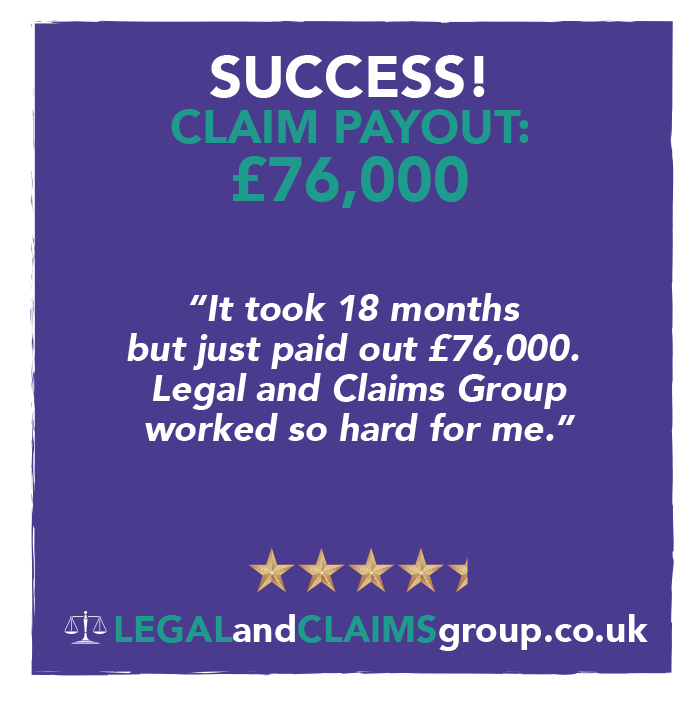

Testimonials

Are You Covered? – Are You Due a Payout? We Can Help!

GET IN TOUCH FOR A FREE CHECK

We will review your policy wording to check if you are due a payout?

We will provide a free PDF of 17 Policy Wordings currently being challenged in court.

Don’t worry if you have been told you’re not covered, let us check for you, for Free.

100% FREE - At no point will Legal and Claims Group charge for any information or help provided.

- We will carry out a Free check on your policy wording to check if you are due a payout?

- Don’t worry if you have been told you’re not covered, let us check for your for Free.

- We can’t stress enough the importance of having this check carried out as we are identifying thousands of customers who have been told they cannot claim or their policy dosen’t cover them and when we check the wording on their policy we find they are due a claim. This can be worth £1000’s of pounds if not £10,000’s to some companies.

- We have access to a large team of insurance professionals, loss adjusters, finance specialists and legal teams. All of our information at Business Interruption Insurance Claims is Free and we do not charge for our service.

- If you are due a claim we would strongly suggest using a qualified solicitor or claims company who specialise in this type of work. Business Interruption Claims can be complex and we have seen many companies unsuccessful with claims not being paid out or receiving less money than they are due as they do not understand the claims process or all the areas they are entitled to claim.

- Even as you read this there are policy documents being challenged in court. There are insurance companies agreeing to pay out on policies they have previously declined. So it’s imperative you let us check your policy wording as customers entitlement to claims are changing daily.

- We have a free download available of some 17 insurance policy wordings that are being challenged shortly in the High Court. We will also be tracking the court decision with theses companies to further assist our customers who maybe due a claim.

Our FREE Services Include

Completely FREE impartial information

20 Years experience in the Insurance industry

Independent & Impartial Information

No Fees Charged

Access to Loss Adjusters

Unlimited Assistance

Policy Wording Checked

Information on Successful Claims & Court Outcomes

Links to the FCA, etc.

Links to the Finance Ombudsman, etc.

Links to the Information Commissioners Office

Top Tips We Know Have Worked

Covid-19 Business Interruption Insurance Claims

The Coronavirus (Covid-19) pandemic and the Government controls impossed as a result are causing a substantial level of loss and distress for businesses, in particular for SME’s. A large number of claims are being made to insurers under the term of business interuption BI Insurance policies. There is continuing and widespread concern about the lack of a possitive response of some of these BI Insurance Policies and the basis on which some insurers are making decisions in relation to claims.

Top Tips

- Check Our Website Regularly

For up-to-date information on court test cases, Government Policies, Insurance Company Payouts, New Laws & Legislation – please check our website regularly. - Don’t Worry If You Have Been Told You’re Not Covered

Let us check your policy for Free. We can’t stress enough the importance of having this check carried out as we are identifying thousands of customers who have been told they cannot claim or their policy doesn’t cover them and when we check the wording on their policy we find they are due a claim. This can be worth £1000’s of pounds if not £10,000’s to some companies. - You May Be Eligible For A Pay-out

Regardless of the wording on your policy you may be eligible for a pay out. - Maximise Your Claim Pay-out

If you are due a claim we would strongly suggest using a qualified solicitor or claims company who specialise in this type of work. Business Interruption Claims can be complex and we have seen many companies unsuccessful with claims not being paid out or receiving less money than they are due as they do not understand the claims process or all the areas they are entitled to claim.

Our Mission is to

* PROTECT LIVES

* PROTECT FAMILIES

* PROTECT LIVELIHOODS

3 Easy Steps to Access FREE Information

Fill in Our Simple Online Form

We will get back in touch to assist with any information

Simply Get in Touch

We're always happy to talk and assist you with any information required

Unlimited Assistance

Their is no limit to how many times you can contact us

Business Interruption Insurance Claims